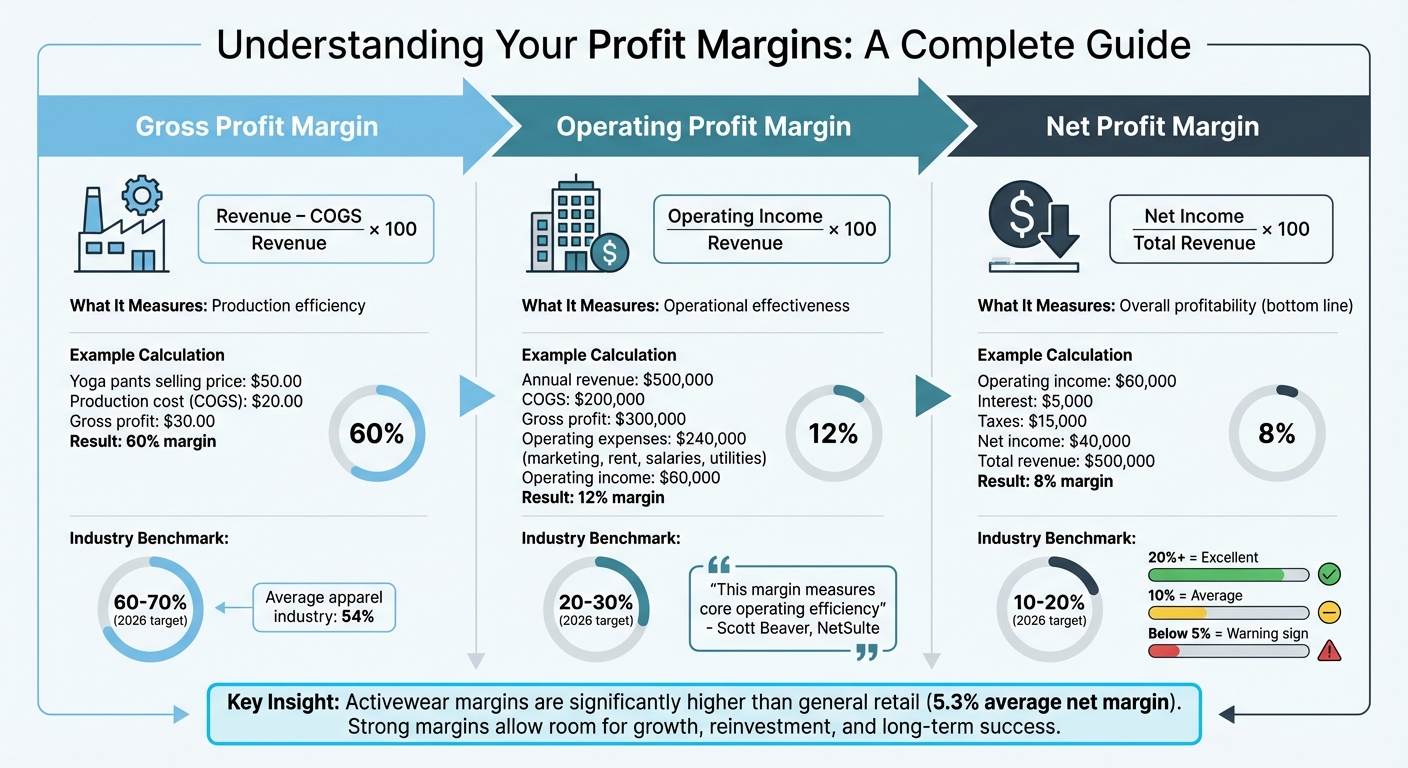

Profit margins determine how much money you keep after covering costs, making them essential for running a successful activewear brand. Here’s a quick breakdown:

- Gross Profit Margin: Measures production efficiency by comparing revenue to direct costs (COGS). Formula:

(Revenue - COGS) / Revenue × 100. - Operating Profit Margin: Includes daily business expenses like rent, wages, and marketing. Formula:

(Operating Income / Revenue) × 100. - Net Profit Margin: Reflects overall profitability after all expenses, taxes, and interest. Formula:

(Net Income / Revenue) × 100.

For example, if you sell leggings for $50 with a $15 cost to produce, your gross margin is 70%. After operating expenses of $25 per unit, the net margin drops to 20%.

Key tips to improve margins:

- Reduce Costs: Source materials strategically and negotiate with manufacturers.

- Increase Efficiency: Focus on quality control to reduce returns.

- Track Metrics: Regularly review margins to identify and address inefficiencies.

In 2026, activewear brands aim for 60–70% gross margins, 20–30% operating margins, and 10–20% net margins. Strong margins allow room for growth, reinvestment, and long-term success.

Is Starting a Sportswear Brand Actually Profitable Here’s the Truth

Key Costs in Activewear Production

To accurately calculate profit margins, you first need a clear understanding of all the costs involved in producing activewear. Breaking these costs down is crucial for precise margin calculations. These expenses are generally divided into two categories: direct production costs (expenses tied to each individual garment) and indirect production costs (expenses that support production but aren’t linked to a single unit). Together, these form your Cost of Goods Sold (COGS) – the foundation for every profit margin calculation.

Direct Production Costs

Direct costs are the expenses that can be traced directly to each piece of activewear you produce. The largest portion typically comes from fabric, which can make up as much as 70% of a garment’s total cost. For activewear, this often includes specialized materials like recycled polyester blends, moisture-wicking knits, or GOTS-certified organic cotton. For instance, 230gsm recycled polyester fleece averages around $3.75 per piece, while 180gsm ring-spun cotton jersey costs about $2.10 per piece.

Trims and findings are another important direct cost that can sometimes be overlooked. These include everything from zippers to labels, and they add up quickly. For performance leggings, trims typically range from $0.80 to $1.20 per unit. By itemizing each trim instead of lumping them into overhead, you can identify areas for potential savings.

Labor costs, often referred to as CMT (Cut, Make, Trim), cover processes like cutting the fabric, sewing, and finishing. Labor is usually calculated based on the garment’s complexity, using metrics like Standard Minute Value (SMV) or Cost-Per-Minute (CPM). While a basic T-shirt might take 8 minutes of labor, activewear with features like flatlock seams and mesh panels takes significantly longer. For performance leggings, labor costs typically range from $3.50 to $5.00 per unit.

It’s also wise to include a 5–10% buffer in fabric costs to account for wastage due to cutting errors or pattern matching. When working with manufacturers like New Dong Huang Garment Co., Ltd., request a detailed tech pack that lists every material, trim, and labor step. This helps prevent unexpected costs from surfacing during production.

Now, let’s look at the indirect costs that also play a major role in your overall expenses.

Indirect Production Costs

Indirect costs don’t tie directly to individual garments but still significantly affect your bottom line. Factory overhead – including rent, utilities, and machinery depreciation – typically adds 10–20% to the unit cost. For activewear, this might translate to an additional $1.00 to $1.50 per piece.

Shipping and freight are another essential consideration when calculating your "landed cost" – the total expense of getting a finished garment to your warehouse. Depending on the shipping method and distance, freight can add anywhere from $2.00 to $3.50 per unit. Customs duties also come into play, often calculated as approximately 10% of the declared value of materials and labor.

Packaging – such as polybags, hangtags, and silica gel packets – along with quality control inspections, rounds out the indirect costs. While packaging might seem minor at $0.25 to $0.50 per unit, it’s crucial for protecting your product and maintaining brand reputation. Combined, these indirect costs can increase your final unit cost by 10–20% or more.

"Costing alone doesn’t save money or mitigate risks, but it does help guide decisions in these areas." – Rebeca Bichachi, Product Marketing Specialist, NetSuite

Cost Breakdown Example

Here’s a breakdown of the complete cost structure for a pair of performance leggings made from a recycled polyester and spandex blend:

| Cost Component | Details | Cost Per Unit (USD) |

|---|---|---|

| Direct Materials | Recycled polyester/spandex blend (1.2 yards) | $4.50 – $6.00 |

| Trims & Findings | High-tension elastic, heat-transfer labels, thread | $0.80 – $1.20 |

| Labor (CMT) | Cutting, flatlock seams, finishing | $3.50 – $5.00 |

| Wastage Allowance | ~10% of fabric and trims | $0.50 – $0.70 |

| Indirect/Overhead | Factory rent, utilities, machinery | $1.00 – $1.50 |

| Packaging | Recycled polybag, hangtags, silica gel | $0.25 – $0.50 |

| Shipping & Duties | Freight + 10% customs duty | $2.00 – $3.50 |

| Total Landed COGS | Complete cost per unit | $12.55 – $18.40 |

This "landed COGS" is your baseline for determining profit margins. For example, if you retail these leggings at $60.00 and your landed cost is $15.00, you have $45.00 in gross profit to cover operating expenses, marketing, and net profit. This detailed cost analysis is the cornerstone of accurate profit margin calculations.

How to Calculate Profit Margins

Three Types of Profit Margins for Activewear Brands Explained

Understanding profit margins – gross, operating, and net – is key to assessing the financial health of your activewear business. Each type of margin sheds light on different aspects of your operations: gross profit margin reveals how efficiently you produce your goods, operating profit margin measures the effectiveness of your daily operations, and net profit margin gives a clear picture of your overall profitability.

Calculating Gross Profit Margin

Gross profit margin focuses on how efficiently your products are made. The formula is:

(Revenue – COGS) / Revenue × 100

Let’s break it down with an example. Say you sell a pair of yoga pants for $50.00, and the cost to produce them (COGS) is $20.00. Your gross profit per unit is $30.00 ($50.00 – $20.00). Divide $30.00 by $50.00, then multiply by 100, and you get a 60% gross profit margin. Considering that the average gross margin in the apparel industry is about 54%, a 60% margin indicates efficient production. If your margin dips below 50%, it might be time to revisit your material costs or find ways to reduce production waste. This foundation of production efficiency is crucial for evaluating the rest of your business operations.

Calculating Operating Profit Margin

Operating profit margin takes into account all the daily expenses needed to run your business – things like marketing, rent, salaries, utilities, and website hosting – while excluding interest and taxes. The formula is:

(Operating Income / Revenue) × 100

Here’s how it works: Imagine your annual revenue is $500,000 from selling 10,000 units at $50.00 each. With a COGS of $200,000 (10,000 units × $20.00), your gross profit is $300,000. Now, subtract operating expenses, which total $240,000 (e.g., $120,000 for marketing, $40,000 for rent, $60,000 for salaries, and $20,000 for utilities and software). This leaves you with an operating income of $60,000. Using the formula, your operating profit margin is ($60,000 / $500,000) × 100, or 12%.

"This margin measures core operating efficiency." – Scott Beaver, Sr. Product Marketing Manager, NetSuite

A 12% operating margin means you’re generating $0.12 of operating profit for every dollar of revenue. This metric serves as a bridge between production costs and overall profitability.

Calculating Net Profit Margin

Net profit margin considers every single expense, including COGS, operating costs, interest on loans, and taxes. The formula is:

(Net Income / Total Revenue) × 100

Starting with the $60,000 operating income, subtract $5,000 in interest and $15,000 in taxes, leaving you with a net income of $40,000. Applying the formula, your net profit margin is ($40,000 / $500,000) × 100, or 8%.

"The most significant profit margin is likely the net profit margin, simply because it uses net income. The company’s bottom line is important for investors, creditors, and business decision makers alike." – Investopedia

An 8% net margin, while slightly below the typical 10% benchmark, still reflects solid performance. For context, net profit margins of around 20% are considered excellent, 10% is average, and anything below 5% could signal financial issues. For instance, in January 2025, general retail had an average net margin of 4.60%, while restaurants achieved 10.62%. To improve your net margin, think about investing in customer retention strategies. Retaining customers generally costs less than acquiring new ones.

| Margin Type | Formula | What It Measures | Your Example Result |

|---|---|---|---|

| Gross Profit Margin | (Revenue – COGS) / Revenue × 100 | Production efficiency | 60% |

| Operating Profit Margin | Operating Income / Revenue × 100 | Operational effectiveness | 12% |

| Net Profit Margin | Net Income / Revenue × 100 | Overall profitability (bottom line) | 8% |

sbb-itb-8dbc09a

Profit Margin Benchmarks and Optimization

Once you’ve calculated your profit margins, the next step is to set benchmarks and find ways to improve them.

Activewear Profit Margin Benchmarks

In 2026, activewear businesses aim for a gross profit margin of 60–70%, an operating margin of 20–30%, and a net profit margin of 10–20%. These numbers are noticeably higher than the average for general retail, where the typical net profit margin is about 5.3%. Activewear, in particular, benefits from strong markup opportunities, with many successful brands achieving margins between 40% and 60%.

"In 2026, clothing stores should aim for 60–70% gross margin, 20–30% operating, and 10–20% net profit margin." – Leah Tran, Content Executive, TrueProfit

Several factors influence where your margins fall within these ranges. For instance, fabric quality is a big one. Premium technical materials like moisture-wicking polyester or GOTS-certified organic cotton may cost more initially but allow for higher pricing. Similarly, products that require advanced manufacturing techniques – such as bonded seams or laser-cut ventilation – tend to have higher production costs but can justify premium price tags. Direct-to-consumer brands often see higher margins because they avoid retailer markups, while wholesale models trade some margin for larger sales volumes. That said, return rates are a critical consideration. Apparel brands often face higher returns due to sizing and fit issues, which can cut into margins by as much as 15–20% if not managed effectively.

Next, let’s dive into how working with experienced manufacturers can help boost your margins.

Improving Margins Through Manufacturing Partners

Strategic manufacturing decisions can play a crucial role in improving profit margins. Partnering with experienced manufacturers can help you cut costs without compromising on quality. One major factor is production efficiency. Specialized factories equipped with advanced tools – like auto-cutters and flat-seam machines – can reduce labor time and material waste, which directly lowers per-unit costs. For example, increasing production volume from 200 to 2,000 units can drop the cost per unit from $11.50 to $7.80, a 32% decrease.

Efficient production systems also play a role. Professional manufacturers often conduct inline inspections and use AQL (Acceptable Quality Level) sampling to catch defects early. This reduces returns and helps maintain brand reputation. For instance, ensuring consistent fit and using pre-shrunk fabrics can lower return rates by over 20%. Companies like New Dong Huang Garment Co., Ltd., which has over 27 years of activewear expertise, combine advanced manufacturing methods with innovative fabric options. They offer features like eco-friendly, quick-dry, anti-odor, and anti-UV materials that add retail value while keeping production costs competitive.

Additionally, small investments in quality finishes can protect margins. For example, adding a moisture-wicking treatment for just $0.35 per unit can justify higher price points. Certifications like OEKO-TEX or GOTS also support premium pricing, especially as around 29% of consumers now prioritize sustainable materials when choosing activewear.

Margin Optimization Example

Let’s look at a practical example. Say a yoga legging costs $15.00 to produce and sells for $50.00. This gives a gross margin of 70%. However, after factoring in operating expenses – like marketing, overhead, and fulfillment – of $25.00 per unit, the net margin drops to 20%, or $10.00 per unit. This example highlights how operating expenses can significantly impact even strong gross margins.

Conclusion

Summary of Profit Margin Calculations

Knowing how to calculate profit margins is a must for any activewear business. The gross profit margin measures how efficiently you produce your products by subtracting direct costs from revenue. The operating profit margin dives deeper, reflecting how well you handle everyday expenses like rent, utilities, and marketing. Finally, the net profit margin is your bottom line – it shows what’s left after covering all costs, including taxes and interest. Together, these metrics can uncover hidden cost inefficiencies and help fine-tune pricing strategies.

For example, if your gross margin looks solid but your net margin is weak, it could signal that overhead or non-operational costs are eating into your profits. Regular reviews – monthly or quarterly – can help you stay ahead of challenges like inflation or rising costs. Remember, higher revenue doesn’t guarantee higher profits. If your expenses are growing faster than your sales, your profitability will take a hit. These insights should guide your strategy to ensure long-term success.

Final Tips for Activewear Brands

Building on the profit margin insights, here are some practical tips to strengthen your business. First, keep a close eye on your margins and use them to guide decisions. A net profit margin of about 10% is generally considered solid, while 20% is excellent. If your margin dips below 5%, it’s a warning sign to reassess your operations.

Consider practical cost-saving measures like buying materials in bulk when prices are favorable, automating repetitive tasks to cut labor expenses, and focusing on customer retention – it’s often cheaper to keep existing customers than to attract new ones.

Partnering with experienced manufacturers can also make a big difference. For instance, New Dong Huang Garment Co., Ltd., with over 27 years of activewear expertise, offers advanced manufacturing techniques and innovative fabrics that help reduce production costs without sacrificing quality.

Lastly, evaluate your product lineup regularly. Eliminate slow-moving inventory to reduce waste and consider refinancing high-interest loans to ease overhead costs. By staying disciplined with margin tracking and making data-driven adjustments, you can build a profitable and sustainable activewear brand.

FAQs

What’s the difference between gross, operating, and net profit margins in activewear?

Gross profit margin tells you how much of your revenue is left after covering direct costs like fabric and production. Operating profit margin digs deeper, subtracting operating expenses such as labor, rent, and marketing from the gross profit. Finally, net profit margin gives you the full picture by factoring in all remaining costs, including taxes, interest, and other non-operating expenses, to reveal the overall profitability of your activewear product.

Grasping these margins is key to assessing your business’s performance at various stages and spotting opportunities to improve.

What are the best ways for activewear brands to reduce production costs and improve profit margins?

Activewear brands looking to boost profit margins should take a close look at their production costs. Start by examining direct expenses such as fabric, trims, and labor, but don’t forget about indirect costs like overhead, freight, and duties. Even small adjustments in these areas can make a noticeable difference in profitability.

Here are some practical ways to reduce costs:

- Choose efficient materials: Opt for durable fabrics that are cost-effective. Bulk purchasing or using recycled fibers can also help lower tariffs and expenses.

- Simplify product designs: Streamlining patterns, cutting back on unnecessary trims, and standardizing sizing can reduce production time and minimize waste.

- Leverage advanced technology: Automated tools like fabric cutters and stitching machines can save both time and labor costs.

- Refine sourcing strategies: Work with manufacturers that offer in-house services, such as dyeing and finishing, to avoid extra fees and simplify logistics.

Partnering with an experienced manufacturer, like New Dong Huang Garment Co., Ltd. – a company with 27 years of expertise and advanced fabric technologies – can make these cost-saving strategies easier to implement. By balancing cost efficiency with quality, activewear brands can strengthen their profit margins while staying competitive in the U.S. market.

What is the expected profit margin for activewear brands in 2026?

Profit margins in the activewear industry for 2026 don’t yet have a clear benchmark. These margins can fluctuate widely based on factors like production expenses, pricing strategies, and shifts in market demand.

Many brands aim for gross profit margins in the range of 40% to 60% to remain competitive. However, the actual numbers often depend on a company’s specific business model and how efficiently it operates. To gain a clearer picture, it’s helpful to review historical data, keep an eye on industry reports, and collaborate with manufacturing experts like New Dong Huang Garment Co., Ltd., known for their expertise in producing and customizing high-quality activewear.