When comparing China and Vietnam for activewear manufacturing, the choice depends on your priorities: cost, speed, or complexity. Here’s a quick breakdown:

- Labor Costs: Vietnam is cheaper at $2.99/hour compared to China’s $6.50/hour. Monthly wages are also lower in Vietnam, making it ideal for cost-sensitive, high-volume production.

- Overhead Per Garment: Vietnam’s costs range from $0.80–$1.50, while China’s are higher due to advanced machinery and automation.

- Infrastructure: China has a well-developed supply chain and technical expertise, perfect for complex garments like seamless activewear. Vietnam’s infrastructure is improving but often relies on imported materials, especially for technical apparel.

- Efficiency: China offers faster production cycles and higher productivity, making it better for intricate designs. Vietnam is more suited for simpler, large-scale orders.

- Trade Agreements: Vietnam benefits from free trade agreements, reducing export costs, especially to the U.S. and Europe. China faces higher tariffs on U.S.-bound goods.

Quick Comparison

| Factor | China | Vietnam |

|---|---|---|

| Labor Cost (hourly) | $6.50 | $2.99 |

| Overhead/Garment | Higher | $0.80–$1.50 |

| Infrastructure | Advanced | Developing |

| Productivity | Higher | Moderate |

| Trade Advantage | Limited (U.S. tariffs) | Strong (FTAs) |

For technical activewear, China’s advanced systems and skilled workforce justify the higher costs. For basics like T-shirts or leggings, Vietnam’s low labor costs and trade benefits make it a smart choice. Many brands now split production between the two – complex items in China, high-volume basics in Vietnam.

China vs Vietnam Manufacturing Cost Comparison for Activewear Production

Is Sourcing from Vietnam REALLY Better than China? (Side by Side comparison)

Overhead Costs in China

When it comes to activewear manufacturing, overhead costs in China extend beyond basic production expenses, benefiting from a highly developed technical infrastructure. China’s advanced systems and dependable utilities significantly reduce disruptions and allow for quicker production turnarounds. Additionally, its well-established supply chain helps cut down on logistics costs.

Overhead expenses in China typically include labor, utilities, factory rent, and compliance costs. These costs, both fixed and variable, are distributed across production runs, which means larger orders often result in lower per-unit expenses. This structure highlights why China remains a key player in activewear manufacturing.

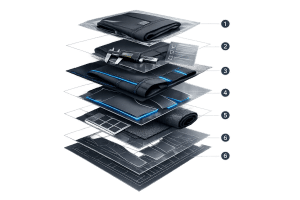

One of China’s standout advantages is its ability to balance higher costs with exceptional efficiency and technical expertise. Many factories are equipped with cutting-edge machinery, like Santoni knitting machines, which are essential for producing seamless activewear. These machines enable the creation of complex garments featuring elements like compression fits, anti-bacterial treatments, and specialized fabrics.

Labor Costs and Benefits in China

As of 2020, labor costs in China averaged around $6.50 per hour. While this rate is higher compared to other manufacturing hubs, it is offset by the specialized skills of Chinese workers, particularly in the production of technical activewear.

In addition to base wages, factories face costs for mandatory social insurance and compliance audits. Larger manufacturing facilities often secure certifications such as BSCI and SEDEX to meet global ethical standards, which is critical for working with international brands.

Minimum wages are steadily increasing across major manufacturing provinces. For example, Zhejiang and Jiangsu are set to introduce new wage standards starting January 1, 2026. Even with these adjustments, labor costs in China remain significantly lower – around three to five times less – than those in countries like Australia.

What truly sets China apart is the speed and adaptability of its labor force. Factories can produce samples in as little as 7–10 days and complete bulk orders within 20–30 days. This efficiency, paired with additional services like quality control and sourcing support, often makes up for the higher hourly wages when evaluating overall project costs.

Electricity and Water Costs in China

Utility costs in China, including electricity and water, vary depending on production volume and market conditions, directly influencing the cost of goods sold (COGS) and final pricing. While per-kilowatt-hour rates differ by region, the country’s reliable utility infrastructure minimizes production delays.

"China boasts state-of-the-art infrastructure, ensuring efficient production and logistics." – Asiansourcinggroup Co. Ltd.

This reliability is crucial for brands operating under tight delivery schedules. For large-scale operations, economies of scale further reduce per-unit utility costs, making bulk production more affordable. Additionally, China’s close proximity to raw material suppliers streamlines the overall cost structure.

Factory Rent and Maintenance in China

Factory rent and maintenance represent fixed monthly costs that are a key part of China’s overhead structure. These expenses cover facility leases, equipment maintenance, and adherence to international manufacturing standards. While higher than in some emerging markets, these costs provide access to advanced machinery and automation technologies that boost productivity.

Fixed costs like rent also play a significant role in shaping China’s manufacturing landscape. Many facilities are designed for high-volume, complex production, requiring substantial investments in specialized equipment, such as seamless knitting machines. These machines demand regular maintenance and calibration, which is why minimum order quantities for seamless activewear often start at 100–150 units per color, size, and style.

In response to rising operational costs and tighter profit margins, many brands are exploring the "China Plus One" strategy – diversifying production to include additional countries. However, for companies that prioritize technical expertise and fast production cycles over the lowest possible prices, China’s factory infrastructure remains a strong choice. Its facilities are well-suited for handling diverse product lines and frequent style updates.

Overhead Costs in Vietnam

Vietnam has become a prominent "China Plus One" destination for activewear manufacturing, largely due to its lower overhead costs. The country ranks second among 11 Asian nations in the 2025 Asia Manufacturing Index, following China. On average, monthly manufacturing expenses in Vietnam are about $79,280 – nearly 45% less than Thailand’s $142,344 and significantly below Singapore’s $366,561.

This cost advantage spans across labor, utilities, and facility expenses. As of 2025, Vietnam’s industrial sector contributes over 20% to the country’s GDP, driven by substantial investments in industrial zones. However, these lower costs are accompanied by challenges in infrastructure development and supply chain maturity.

While Vietnam offers a cost-effective manufacturing base, its infrastructure is still evolving. Many factories rely on imported components and trims from China, which can affect total landed costs despite the lower overhead. To stay competitive, the Vietnamese government has introduced initiatives aimed at reducing business costs by at least 30% by 2025. Let’s take a closer look at how these savings break down across key overhead categories.

Labor Costs and Benefits in Vietnam

Vietnam’s labor costs are a major factor in its appeal. Workers in Vietnam earn an average of $2.99 per hour, significantly lower than China’s $6.50. Monthly minimum wages range from $130 to $190, far below China’s $300 to $400 or more. This wage difference has driven major brands like Nike to shift production – by 2024, Vietnam accounted for 52% of Nike’s global footwear production, while China’s share fell below 19%.

However, lower wages don’t always equate to lower total costs. Vietnam faces workforce challenges, including a turnover rate exceeding 35% and labor instability. In 2022 alone, over 260 labor disputes and strikes occurred, marking a 25% increase from 2021. Labor costs typically represent 20% to 30% of a garment’s FOB price, meaning efficiency and stability are critical factors.

"Low-cost labor doesn’t necessarily translate to low total cost – especially from the perspective of B2B brand clients who prioritize fast turnaround and high consistency." – Heva Shoe Inc

To address these challenges, many Vietnamese factories are adopting international compliance standards like WRAP and SA8000. While the workforce excels in high-volume production, they currently lack the technical expertise required for complex activewear, such as seamless knitting or compression garments. As Adidas explained, "Vietnam will continue to serve as its primary hub for large-scale production, while China will focus on more complex and higher value-added manufacturing".

Electricity and Water Costs in Vietnam

Utility costs in Vietnam further enhance its appeal as a manufacturing hub. These expenses vary depending on production scale and demand. Vietnam holds the position of having the second-lowest average business operating costs among nine Asian nations, making it particularly attractive for labor-intensive garment production.

Despite its affordability, Vietnam’s utility infrastructure isn’t as efficient as China’s. For instance, peak production periods and night shifts often lead to higher electricity charges, while overtime operations increase both utility consumption and worker overtime pay, which can rise by 130% to 300%.

Environmental conditions also play a role. High humidity and heat in garment factories lead to increased utility usage for ventilation and cooling systems. International brands require facilities to meet strict safety and operational standards through certifications like BSCI and Sedex, which adds to overhead costs.

Factory Rent and Maintenance in Vietnam

Factory rent and maintenance costs in Vietnam vary widely depending on location. Urban centers like Hanoi, Ho Chi Minh City, and Da Nang demand roughly 39% higher costs than rural areas.

To attract foreign investment, Vietnam has heavily invested in industrial zones and offers incentives such as land rental exemptions and duty tax reductions. This aligns with the "China Plus One" strategy mentioned earlier. However, Vietnam still lags behind China in terms of logistics and infrastructure, which can lead to supply chain disruptions during peak demand.

Factories producing for international brands must invest in maintenance to meet certifications like BSCI, Sedex, and GRS. Businesses seeking Vietnamese suppliers are advised to vet facilities for "export-readiness", as mid-sized suppliers may lack the scale or quality control systems needed for global orders. Working with local agents or inspectors can help navigate regional complexities and ensure factory capabilities align with production needs. These factors highlight the importance of balancing cost savings with operational readiness when selecting a manufacturing location.

China vs Vietnam: Side-by-Side Cost Comparison

Cost Comparison Table

The cost differences between manufacturing in China and Vietnam vary across several key factors. Here’s a detailed comparison:

| Cost Factor | China | Vietnam |

|---|---|---|

| Labor Cost (per hour) | $6.50 | $2.99 |

| Monthly Minimum Wage | $214 – $374 | $137 – $196 |

| Overhead Costs (Utilities/Rent) | Low | Low |

| Overhead per Garment | Higher (due to automation/tech) | $0.80 – $1.50 |

| Infrastructure | Advanced / Integrated Clusters | Developing / Improving |

| Supply Chain | Comprehensive / Localized | Growing / Dependent on Imports |

| Production Efficiency | High (more output per worker) | Moderate (rapidly closing gap) |

Vietnam’s labor cost of $2.99 per hour offers a 54% savings over China’s $6.50 per hour. Similarly, Vietnam’s monthly minimum wage, ranging from $137 to $196, is significantly lower than China’s $214 to $374. However, these numbers don’t fully capture the broader picture. China’s advanced infrastructure and integrated manufacturing clusters often lead to higher worker productivity and fewer defects, which can balance out the higher wages.

Utility and rent costs are low in both countries, but China’s investment in technologies like AI-driven quality control and automated cutting systems adds to maintenance expenses while improving production speed and accuracy. On the other hand, Vietnam’s overhead costs per garment, particularly for basic items like shirts, typically range between $0.80 and $1.50, covering utilities, administrative expenses, and compliance requirements.

How Cost Differences Affect Pricing and Margins

These cost variations have a direct impact on product pricing and profit margins. For example, producing basic cotton shirts in Vietnam costs between $6.00 and $12.00 for small orders (around 100 pieces) and drops to $4.00–$7.00 for bulk orders (1,000 pieces). In comparison, China offers lower costs for similar items, with basic cotton t-shirts priced at $2.50–$4.00 and heavyweight hoodies ranging from $12.00 to $18.00.

Labor costs typically account for 20%–30% of a garment’s FOB (Free on Board) price, meaning wage differences alone have a limited effect on the total landed cost. However, Vietnam’s dependence on imported materials – primarily sourced from China – can lead to hidden costs and longer production timelines.

For brands seeking better margins, placing minimum order quantities (MOQs) of 500 to 1,000 pieces in Vietnam can lower per-unit costs by 20% to 40%, as overhead and compliance expenses are spread across larger volumes. Meanwhile, China’s advanced automation and quicker turnaround times make it a strong contender for producing complex garments like activewear, which require specialized techniques such as bonding, laser-cutting, or multi-panel construction – even with higher nominal wages.

sbb-itb-8dbc09a

What Drives Overhead Cost Changes

The evolving landscape of overhead costs in China and Vietnam stems from several key factors, including wage trends, tax policies, trade agreements, and advancements in manufacturing technology. These elements shape the financial and operational decisions for businesses in both countries.

Wage Growth and Economic Conditions

Wage growth is a major factor influencing overhead costs, but it’s playing out differently in China and Vietnam. While Vietnam still has a wage advantage, rising pay rates are narrowing the gap.

In Vietnam, garment workers face an annual wage increase of about 3.3%, which often falls short of keeping up with the cost of living. To earn an average monthly income of $400, many workers rely on overtime – up to 80 hours per month – because their base salaries are only slightly above the regional minimum wage. This dependency on overtime contributes to a high turnover rate of 20.3% as workers search for better opportunities.

"To reach this 400 USD income, workers must depend heavily on overtime and extra work hours, while their actual basic salary is only slightly above the regional minimum wage." – Talentnet

Meanwhile, China’s higher base wages are counterbalanced by far greater labor productivity. While Vietnam ranks 136th out of 185 countries in labor productivity, Chinese workers deliver more output per hour due to better training and supply chain integration. This productivity advantage allows Chinese factories to offset their higher hourly wage of $6.50 compared to Vietnam’s $3.00. For complex products like technical activewear, China’s skilled workforce achieves lower per-garment labor costs.

These wage and productivity dynamics create the foundation on which external factors – like policies and technology – further shape overhead costs.

Tax Policies and Trade Agreements

Tax and trade policies have become pivotal in determining manufacturing costs, particularly for goods bound for the U.S. market.

Since January 2026, U.S. tariffs on Chinese imports have increased by an additional 10%, with some duties reaching as high as 45%. These tariffs significantly raise the landed costs for U.S.-bound goods, making Chinese manufacturing less attractive for American brands.

Vietnam, on the other hand, benefits from its favorable trade relationships. The U.S.-Vietnam Comprehensive Strategic Partnership gives it an edge as a preferred trading partner, and the country has access to 15 free trade agreements, including the CPTPP and EVFTA, which open doors to European markets. In contrast, China largely depends on the Regional Comprehensive Economic Partnership (RCEP), which doesn’t include the United States.

However, Vietnam’s manufacturers face compliance challenges. U.S. Customs has ramped up enforcement against transshipment fraud, where goods made in China are falsely labeled as "Made in Vietnam" to avoid tariffs.

"Tariffs of up to 45% on many Chinese imports have made Chinese manufacturing significantly more expensive for U.S.-bound goods." – Daniel Harris, Harris Sliwoski

Domestically, both nations offer tax incentives to attract investment. China provides Corporate Income Tax reductions for high-tech enterprises, while Vietnam offers preferential tax rates and VAT reductions, particularly in special economic zones. Vietnam is also planning new tax incentives aimed at high-tech and semiconductor investments to diversify beyond basic garment manufacturing.

Automation and Manufacturing Technology

Technology adoption is reshaping manufacturing in both countries, though the approaches and impacts differ significantly.

China leads the way with "smart factories" that integrate artificial intelligence and robotics. These investments require significant upfront costs but lower per-unit overhead for high-volume production. The Industrial Digital Transformation Blueprint, set to upgrade Chinese manufacturing by 2026, further underscores this commitment.

Vietnam, with its lower labor costs of $3 per hour compared to China’s $6.50, has been slower to adopt automation. However, rising wages are sparking interest in automation as a way to stay competitive. Experts estimate that 40% to 70% of labor time in the apparel industry could be reduced through automation, which would challenge Vietnam’s low-cost advantage.

"The competitive advantage of Vietnam as a manufacturing destination is not likely to erode overnight, but the hiccups that surfaced in 2023 highlight the need to shift from being positioned as a cost-effective to a productive manufacturing destination." – Matthieu Francois, Partner, McKinsey

Automation’s impact also depends on the complexity of production. For technical activewear requiring specialized processes like bonding and laser cutting, China’s advanced infrastructure reduces defect rates and accelerates production timelines, lowering overall overhead despite higher equipment maintenance costs. For instance, an electronics manufacturer in Asia reported a 25% to 35% productivity boost by using data to optimize manual workloads, proving that even small-scale digital tools can offset labor costs.

In Vietnam, selective automation is addressing specific bottlenecks. Tools like dynamic scheduling systems and on-station performance screens improve labor efficiency without massive capital investments. This gradual approach allows Vietnam to manage overhead costs while building the technological foundation needed to compete on productivity rather than just price.

Each of these drivers – wages, policies, and technology – plays a crucial role in determining the optimal location for activewear production.

Choosing Between China and Vietnam for Production

How to Select the Right Manufacturing Location

When deciding between China and Vietnam for production, it’s essential to weigh several factors beyond just labor costs. While labor accounts for only 20–30% of a garment’s FOB price, the full picture includes product complexity, volume requirements, and total landed costs.

The type of product you’re manufacturing plays a big role in this decision. For example, China’s industrial hubs in Guangzhou and Zhejiang are well-known for their advanced techniques, like seamless knitting and compression fits, making them ideal for technical activewear. On the other hand, Vietnam’s lower labor costs make it a better choice for high-volume basics like leggings, T-shirts, and uniforms.

"The optimal solution is not choosing one country over another, but allocating each part of your production to the location that offers the best cost-performance ratio."

– East West Basics

Speed-to-market is another critical consideration, especially for seasonal collections or fast fashion. Nike, for instance, shifted 50% of its footwear production to Vietnam in 2023 while still relying on China for more intricate technical designs.

Tariffs and trade agreements also play a role. Vietnam benefits from free trade agreements like the CPTPP and EVFTA, which align with the "China Plus One" strategy. However, a complete landed cost analysis is necessary, factoring in productivity, defect rates, material import costs, and shipping duties.

If sustainability is a priority, certification availability is another key factor. China leads in facilities certified by OEKO-TEX, GOTS, and BSCI, which are important for eco-conscious activewear. Vietnam is catching up, with 60% of its national standards now aligned with international benchmarks, but options remain more limited for brands needing comprehensive documentation.

By considering these factors, you can determine the best manufacturing strategy tailored to your product and business goals.

Working with New Dong Huang Garment Co., Ltd.

Navigating these production challenges requires an experienced partner, and New Dong Huang Garment Co., Ltd. brings 27 years of expertise in activewear manufacturing to the table. Based in China’s robust supply chain ecosystem, the company specializes in technical performance apparel like yoga wear, running gear, and outdoor clothing. Their proximity to advanced fabric mills and trim suppliers ensures streamlined operations.

New Dong Huang addresses overhead concerns with full-package capabilities. Their in-house bonding machines, laser cutting equipment, and automated quality control systems enhance productivity, offsetting higher labor costs. Their impressive 99% on-time delivery rate is a testament to the benefits of consolidating production – from fabric sourcing to finishing – within a single industrial cluster.

The company also offers custom design services to cut costs early in the development process. From trend research and tech pack creation to pattern making and fabric selection, their team simplifies the workflow and minimizes hidden costs that can arise when managing fragmented supply chains.

New Dong Huang is certified by BSCI, Sedex, and GRS and has passed audits for major brands like Nike and New Balance, ensuring compliance and thorough documentation. Their fabric innovations include eco-friendly options with features like anti-odor, quick-dry, and anti-UV properties, leveraging China’s advanced textile R&D capabilities. For brands producing complex activewear with specialized construction needs, New Dong Huang’s integrated approach makes China a smart choice, even with higher labor costs.

Conclusion

While overhead benchmarks provide some insights, the real game changers in manufacturing are supply chain efficiency and total landed costs. Take labor rates, for example: in Vietnam, the average is about $3.00 per hour, compared to $6.50 in China. But the true cost difference becomes evident when you consider factors like supply chain integration and overall efficiency.

China’s manufacturing ecosystem is incredibly well-connected. Factories can source fabrics, trims, and packaging within a 62-mile (100 km) radius, cutting down lead times and reducing indirect overhead costs. On the other hand, many Vietnamese factories rely on importing performance fabrics and specialized components from China. This adds logistical challenges, especially for technical activewear that demands precision and tight schedules.

Infrastructure also plays a key role. China boasts seven of the world’s ten busiest container ports, ensuring frequent sailings and reliable schedules. Vietnam, while improving, still faces hurdles like longer port dwell times and occasional congestion.

Ultimately, sourcing decisions go beyond just labor costs. It’s about finding the right match between your product’s requirements and manufacturing capabilities. For technical activewear requiring advanced machinery and skilled labor, China often comes out ahead. Meanwhile, Vietnam’s lower labor costs make it a great choice for high-volume basics like T-shirts and leggings. Many brands now adopt a "China Plus One" approach – using China for complex items and Vietnam for simpler, high-volume products. This strategy helps balance trade risks while keeping costs in check.

FAQs

What should I consider when deciding between China and Vietnam for activewear manufacturing?

When deciding between China and Vietnam for producing activewear, several factors come into play, especially labor costs and overhead expenses. Vietnam typically stands out with lower labor costs, where minimum monthly wages range from $137 to $196. In contrast, China’s average minimum wage is significantly higher at $374. Vietnam also tends to offer more affordable utilities and factory space. On the other hand, China’s well-established supply chains – featuring fabric mills, dyeing houses, and trim manufacturers in close proximity – can streamline material handling and shorten lead times, particularly for complex designs.

Production capacity and expertise also weigh heavily in this decision. China boasts a larger number of specialized factories equipped with advanced automation, making it a strong choice for high-volume production or intricate designs. While Vietnam is rapidly expanding, its capacity remains smaller, and it often depends on imported materials, which can result in longer lead times. Both countries are capable of producing high-quality activewear, but China’s extensive experience with performance fabrics gives it an advantage when it comes to highly technical garments.

Lastly, trade policies and logistics play a pivotal role. U.S. tariffs on Chinese apparel can drive up costs, which has led many brands to consider Vietnam as part of a "China Plus One" strategy. Vietnam benefits from favorable trade agreements and a growing port infrastructure, making it an appealing choice. However, China’s mature logistics network still ensures faster shipping times. Ultimately, the right decision will depend on how you prioritize costs, production capabilities, quality, and geopolitical considerations for your brand.

How do trade agreements influence the cost of producing activewear in China and Vietnam?

Trade agreements significantly influence the cost of manufacturing activewear in China and Vietnam, especially for U.S.-based brands. Vietnam enjoys the benefits of favorable U.S.–Vietnam trade agreements, which have reduced or eliminated many import duties on textiles and apparel. Thanks to these agreements, Vietnamese factories can offer more competitive pricing for shipments headed to the United States. Reduced tariffs, particularly under "rules-of-origin" provisions, give U.S. brands a pricing advantage when sourcing from Vietnam.

On the other hand, China faces much steeper U.S. tariffs on many apparel products, often surpassing 20%. These higher tariffs stem from recent trade disputes and significantly raise the landed cost of activewear made in China. This makes Chinese-made products less cost-competitive for U.S. imports, even though China boasts an extensive manufacturing infrastructure and a well-integrated supply chain. As a result, Vietnam has emerged as a more cost-effective option for activewear production, providing U.S. brands with a way to balance cost efficiency and product quality.

How does automation impact overhead costs in activewear production in China and Vietnam?

Automation is reshaping how overhead costs are managed in both China and Vietnam, but the effects vary significantly between the two. In China, the use of advanced automation – like robotics and computer-controlled sewing systems – has increased fixed costs. These costs stem from factors like equipment depreciation, energy usage, and maintenance. On the upside, such technologies boost efficiency and allow factories to produce more per worker. This higher output helps spread costs over larger production runs, effectively lowering labor costs per unit.

In contrast, Vietnam is still in the early stages of adopting automation. Most factories rely heavily on manual labor, which means overhead costs are mainly tied to wages, utilities, and basic equipment. However, as labor costs rise, Vietnamese manufacturers are beginning to explore automated solutions. Over time, this gradual shift toward automation is expected to balance overhead expenses between labor and capital investments, enhancing productivity and reducing dependence on manual work.